This is a CU Colorado Springs student blog for the following courses: Economic Freedom, and Power & Prosperity.

Wednesday, December 14, 2005

What is GAO and Who is David Walker?

When Walker was asked by his host Brian Lamb, “Why do we need the GAO?”

Walker responded, “We need the GAO in order to try to help the Congress discharge its constitutional responsibilities to assure the performance and help – pardon me (ph) – improve performance and assure accountability of government for the benefit of the American people, to help it discharge its oversight responsibilities, its authorization responsibilities and its appropriations responsibilities. So, we are the watchdog for the Congress. And I think our primary client is the Congress, but our beneficial client is the American people.”

The GAO seems to be a fairly good agency, which is often called the "congressional watchdog" because it investigates how the federal government spends taxpayer dollars. It gathers information to determine how well executive branch agencies are doing their jobs. Its investigations answer such basic questions as whether government programs are meeting their objectives or providing good service to the public. Ultimately, GAO ensures that government is accountable to the American people.

GAO supports congressional oversight by:

· evaluating how well government policies and programs are working;

· auditing agency operations to determine whether federal funds are being spent efficiently, effectively, and appropriately;

· investigating allegations of illegal and improper activities; and

· issuing legal decisions and opinions

As I mentioned, the GAO seems like a very good agency, which offers some very useful information to Congress, but what good is it if all they do is provide it and it is never utilized. Congress doesn’t seem to be taking the GAO’s advice, if you take a look at the Social Security and Medicare program (to name a few). It does give Congress some accountability but it also puts a lot of pressure on Congress because the information is available to the media and special interest groups. The media and special interest groups can utilize this information to inform the American people on how well the elected officials in Congress are listening to the GAO’s advice. I think it is good that we have “congressional watchdogs” but what good is a dog that just watches and is not allowed to "bite", to ensure reform of some current programs. It is probably the people who need to do the biting by electing officials who stand behind their promises.

Links: <http://www.gao.gov/> and <http://www.qanda.org/Transcript/?ProgramID=1014>

Monday, December 05, 2005

Economics and Government: O'Reilly's Price Theory Again

"You should remember that earlier this semester we talked about Bill O'Reilly's analysis of gas price increases following Katrina. You may also have noticed that our fearless leaders in Congress are still talking about 'windfall profits,' while the prices you are paying for a gallon of gasoline have fallen significantly of late. Well, apparently O'Reilly is still holding to his earlier analysis."Read the rest.

Saturday, December 03, 2005

Baseball & Economic Development

"The city and MLB worked to finalize the terms of the lease yesterday, but it was not completely done. It is unclear whether the council will approve it when it votes. Many council members have threatened to vote against the lease if it does not contain additional financial commitments from baseball, and some members said they will reject it because they favor building the ballpark near RFK Stadium, where it could be less expensive.I think there are a few things to note:

City officials, including Mr. Williams, insisted yesterday the RFK site is not necessarily cheaper because it would have a smaller impact on economic development in the area and because the city already has sunk more than $100 million into the South Capitol Street site. MLB officials said they would consider the RFK site only if Mr. Williams asked for it. The city is doing an updated cost estimate for the RFK site and expects the results shortly."

1. Apparently some on council say they think a site near the existing RFK Stadium would be less expensive. I suspect this isn't what they really think. I suspect they think if located at RFK their constituents will benefit (and that they will have greater chances of re-election).

2. Note the reference to cheaper and smaller economic impact in the second paragraph. This seems confused to me. From an economic point of view, we would probably say that emphasis on being less expensive is a bit misplaced. The real interest should be which location for the facility would mean the community enjoyed greater net benefits. Smaller cost, other things constant, would mean greater net benefits. But greater benefit, other things constant, also means greater net benefits. Economics advises that the facility should be located at the site that means greatest net benefits.

3. There is a reference to having sunk $100 million on one of the sites already. Sounds like a sunk cost to an economist, and that means the number $100 million should be seen as irrelevant to the best decision to make moving from now and into the future. Unfortunately, the reference here to the relevance of a sunk cost is an illustration of a common economic mistake made in debates of the best public policy to choose.

4. Consider the reference to the economic impact at one site versus another site. The idea is to pick which site provides the greatest economic impact. Unfortunately, economic impact is not the same as net (social) economic benefit. Instead the reference is to estimates of jobs, spending, and taxes. The idea here illustrates a common mistake in economic development discussions. The economic impact on jobs, spending, and taxes invariably consider only government spending money to build the facility. Of course the money to build the facility comes from somewhere. The estimates of economic impact never show estimates of jobs, spending, and taxes that would have been "generated" if the money spent on the project had been left in taxpayer pockets. Interest in economic impact is simply bad economics, and is very likely to lead to public policy that contributes to relative economic decline rather than to true economic development. Of course, good economic analysis would emphasize the question of whether we have a source of market failure. If we had a source of market failure, then we might well have reason to think a good choice of public policy would enhance economic development of the community. But, without a source of market failure, we have to expect government's choices will not be efficient and hence will not contribute to the community's economic development.

Thursday, December 01, 2005

Supreme Court's Abortion Case

Corporate Welfare

Agriculture is one of the most interfered-with industries on earth. Across the world, government subsidies wreak havoc with farm economies. Though we haven’t made much progress in eliminating the payments, this concept is increasingly understood by Americans. Many people believe that the low income of farm families justifies farm subsidies. But in reality most of the subsidies go to large farms and big agricultural businesses. Recently President Bush said that the U.S. would eradicate its farm subsidies “as other countries do the same.” I would like to know what is preventing him in the first place. Eliminating these subsidies would save tax payers money, lower the cost of food, encourage international trade and lower global poverty, as well as promote increased domestic production. What’s less appreciated is that subsidies also cause environmental problems. By encouraging the cultivation of unneeded marginal land, overuse of scarce environmental resources, and increased use of chemicals, farm subsidies harm the land as well as consumers.

The government spends $9.3 billion dollars a year on farm subsidies. Apart from the apparent burden on tax payers, it hurts Americans in a number of other ways too. The Organization of Economic Cooperation and Development estimated that in 2004 government subsidies cost the country $46 billion dollars a year through direct taxation coupled with the high domestic food prices brought on through the tariff quotas that kept lower priced foreign food out. Cutting these subsidies would save a lot of tax payer’s money, like 9.3 billion a year, and would lower domestic food prices, especially helping lower income families that spend a higher portion of their budget on food. By abolishing these subsidies we would rely more on foreign produced food. We would then be able to save $46 billion dollars a year through cheaper food from international trade along with the money we would save in taxes. Also, many farmers from poor countries would be able to raise their incomes, and this would be a significant step to ease tension between third world countries and the

Lastly, by supporting prices above the market-clearing level, governments encourage farmers to expand production. Agricultural subsidies that stimulate larger production further increase the tax burden to consumers, and impede international trade. In some cases the government actually pays farmers to not produce their maximum through deficiency payments. This program encourages farmers to intensify production and to plow up more land, often highly erodible, to qualify for larger government deficiency payments. These practices would be reduced, along with the use pesticides and chemicals, if subsidies were eliminated.

Wednesday, November 30, 2005

Alternative minimum tax a new tax all together.

The AMT is a tax that is paid if the AMT tax amount exceeds the amount you would normally pay for the regular taxes. There is one deduction that can be taken. While, you can't deduct state, local and foreign taxes under AMT rules, you can deduct the refunds, which would be considered income under the regular tax rules. You’re also taxed on the spread on your incentive stock options; because of this your tax basis for the shares you bought is higher under the AMT, meaning your tax bill will be lower when you sell the shares. The more exemptions you have the more likely it is that you will have to pay the AMT. You really only have to find out which tax you have to pay if your gross income is $75,000 or more. The AMT makes you pay 26% on the first $175,000 and 28% on the excess. An example of having to pay the tax is as follows: Your regular income tax is $47,000. When you calculate your tax using the AMT rules, you come up with $58,000. You have to pay $11,000 of AMT on top of the $47,000 of regular income tax. The last thing you need to know about the AMT is that is does not recognize inflation.

First I want to say that the AMT is a flat tax rate. This is because everyone who has to pay the AMT pays 26% of there income no matter what, and if they exceed $175,000 then they pay 28% on the extra money no matter what.

Because the AMT does not recognize inflation this means every year more and more people will be paying the AMT. In my research I have found in several places that in the year 2010 the AMT will affect 33 million taxpayers. This is a great thing for people who like me like and support flat taxes. The only problem is that when state taxes and social security is added you’re paying out about 33% or a third of your income. I would love to make $175,000 a year but I am not too happy to hear that I would lose $58,333 resulting in $116,667 for the cost of living. I feel that 33% is way too much for anyone to have to pay to the government.

As for the deduction, they are very rare. If you aren’t going to get a refund from the federal government because you make too much money, do you really think your going to get a refund back from the state. Secondly, being taxed on the spread on your incentive stock options is a catch 22. If you buy 10 shares of a stock at $100 then under the AMT rules you have to pay taxes on the $1000. In a best case scenario say the stock value goes up from the $1000 to $2000. The AMT forces you to pay additional taxes on the $1000 you made. Now instead of the stock going up, say the stock goes down and that $1000 becomes $100 and you sell it. You would have to pay taxes like you still had the $1000 instead of paying taxes on the $100.

The last major thing that I think is wrong with the AMT is that it hurts the middle class more so then the upper and lower class. The lower class doesn’t have to pay the AMT ; in fact most end up getting refunds. This tax was originally designed for the upper class, so that they wouldn’t be able to have all these deductions, such as huge business expenses, and get out of paying a “fair share” of taxes. Now the middle class is getting hit with the AMT and all the deductions are going away. In fact the AMT seems to discourage marriage and having children. This is because people who have to pay the AMT loose the deductions others get for marriage and having children. You can’t throw your child to the wolves just because you don’t want another exemption, which can make it so that you have to pay the AMT. So now that the cost of living has gone up and your middle class with a spouse and two kids and you have to pay the AMT you may have some trouble saving money for the children’s college or for your retirement. (Since we know that we are never going to see our social security money.)

In conclusion, as much as I dislike the progressive tax, it works and it seems to be a lot better then the AMT. Unfortunately, I know that I will probably have to pay the AMT. The only solution is to get rid of the tax system as we know it and install a flat rate tax that recognizes inflation, and takes at most 20% of income. The flat tax should also start at a certain income level say $30,000. In this way, there will be no deductions and the people who are under the taxable income won’t get any refunds. But I don’t think I’ll get my hopes up, it will probably never happen.

some webcites to learn more :

http://www.fool.com/taxes/2003/taxes030926.htm, http://www.smartmoney.com/tax/filing/index.cfm?story=amt, http://money.cnn.com/2005/11/09/pf/taxes/amt_101/?cnn=yes

Regulating Video Games

As the video game industry has grown by leaps and bounds the past decade, more and more vulgar and offensive games have been released, all to the dismay of many politicians. Many congressman and state officials have regarded that playing these violent and adult themed games might lead to unethical action later in life. They say kids will be so affected and influenced by these games to the point where they might even emulate what they are able to do in virtual reality in real life. There is hardly a correlation that playing video games will make you a violent person, and between 1994 and 2000 juvenile and young adult violent crime arrests have decreased by 44 and 24 percent respectively.

But Yesterday Senators Hillary Clinton and Joe Lieberman announced they would introduce legislation to prohibit retailers from selling video games rated "mature" or "adults-only" to teenagers. Their argument that this bill will empower parents by protecting their kids is inapt. Parents should regulate what their kids are playing because they know what material is best suited for their children. The Entertainment Software Association noted that all the new video game consoles include parental controls that can limit children's access to graphic content, similar to the V-chip embedded in new television sets. In addition, Congress isn’t supposed to have this kind of police power. If violent video games were a real threat to pubic health, then it’s in each of the States hands to protect its people. And so Governor Gary Locke of

I believe Congress as well as state officials doesn’t have the right regulate video game sales. There is no market failure involved with selling violent games to minors, so there is no reason for Congress to legislate. Furthermore States shouldn’t be using their police power to regulate these offensive games because it’s quite clear that these video games are not a threat to the safety of the pubic health, and regulating these video games is a violation of free speech under the 1st Amendment. Parents are in the best position to regulate what their kids are playing. They are in a far more superior position to know if a video game is unsuitable for their children, not the government.

Another Time for Choosing

Constitutional law is a difficult subject to speak upon because not many American citizens completely know the Constitution or can be quickly brought up to speed on precedents. For example, I think tax laws are knowable, but I wouldn't want to be a judge in that area, as it is a specialised field with a lot of traps for the unwary. To those that think any intelligent citizen can become an effective Supreme Court Justice because Constitutional Law is simple, they portray that they either don't know how complicated the subject can be--e.g. The dormant commerce clause, Colorado River abstention, Footnote 4 of Carolene Products--or that the politicians want a results oriented justice and are unconcerned how a justice makes his decisions. Just because something is knowable does not mean it's simple. If one believes constitutional law is at once knowable, complicated, and specialised, it's obvious why judges and other lawyers of great achievement and demonstrated intellect and knowledge of the field are the ones that you want making decisions. Without their intellect, their random and uninformed decisions will often be wrong and unpredictable.

Why do judges write opinions at all if the work they do is so obvious and the issues so straightforward? And what does it say about judicial claims of authority that they have long been staked on written opinions that have narrative integrity, both in a single case, and with respect to the law as a whole? Without power of their own, the judiciary depends upon its ability to justify its own assertions against those with physical power, namely the executive and legislative branches. This has been accomplished historically through written opinions that show a transparent and reasonable decision-making process. Opinion writing shows respect for the litigants and the process that is always somewhat suspect due to the absence of popular control over the judiciary. Writing opinions shows that what took place ultimately stemmed from the intersection of human reason, written laws with discernable meaning, and the facts of a particular case. That opinion is written thoughtfully and clearly is of fundamental importance to the integrity of the process and the reputation of the courts. The obvious results-oriented decisions of the 1960s did a great deal to discredit the courts, when ordinary people could discern that what had taken place was sophistry. Writing judicial opinions--like the analytical and writing process of so much law it--shows that a result alone is not enough.

The best and brightest lawyers have long been propelled into the judiciary. By best, I don't mean wealthiest or most persuasive in a courtroom, but those most capable of thoughtful, deliberate, and rigorous legal reasoning. It's important for politicians to recognise that this task can be both objective--or at least with a range of reasonable disagreement--but also requires specialized training and a well-trained, capable intellect. It's no more elitist to recognise this fact in the realm of constitutional reasoning, than it is in the realm of physics or math or other specialized fields.

Health care is not a 'right'

The campaign for socialized medicine in the US has long been a goal of several well-meaning politicians. So besides the lack of details, the class warfare rhetoric, and the doublespeak, most promises are merely a step in achieving something they dare not propose openly: the complete government takeover of the healthcare industry. Those who advocate universal healthcare have a disdain for capitalism and market economics and are really just continuing the push toward socialized healthcare that started with the failed policies of the New Deal and the Great Society. Our healthcare system is sick because of 30 years of socialization, not 'market failure'. Not surprisingly many claim the problem is market failure, greed, and the pursuit of profit.

Many states have regulated health insurance so extensively that even basic plans are expensive. In fact, health savings accounts aren't available in Maryland, Hawaii, or New Jersey. Requiring states to deregulate insurance--which Congress could easily do by allowing out-of-state insurance purchases--would mean that all Americans have the opportunity to buy basic plans. Over the years, Medicare's administrators have written, literally, more than 100,000 pages of rules governing clinics, hospitals, and physicians. This mountain of paperwork means that time and energy will have to be expended bureaucratic compliance instead of patient care. Furthermore, Medicare pricing, and insisting that it apply to everyone but managed care, means that competitive pricing doesn't exist for many services. Washington needs to cut the red tape.

If the system as it is now is broke, how do the politicians propose to fix it? The easy answer is to have the government pay for it. This will cost anywhere from $650 billion to a trillion dollars over the first ten years. The odds are it will cost a lot more than that, just like every other government initiative whose initial cost is always underestimated and downplayed. No mention of the mountains of paperwork and regulation that come from existing government meddling in healthcare. No mention of the already existing and massive subsidies that have driven up the cost of healthcare. No mention of the expensive litigation trial lawyers that have put doctors out of business and raise the cost of health care for all of us.

Exactly how does shifting the payment from the customer to government lower costs? Politicians are engaging in pure sophistry; by shifting the cost from individual to taxpayer, the politicians will be raising the cost for all of us, increasing administrative costs, bureaucracy, waste, fraud, inefficiency, and abuse, all the things he says he wants to eliminate from private sector health care but which exist in spades in government by its very nature.

The main problem with a single payer system is that it short circuits market forces, which like gravity, continue to operate nonetheless. Many seem to believe that competition and the profit motive are what drive up the cost of healthcare. Any reform that does not address this central problem is doomed to failure. The further removed the patient is from actually paying for medical services the more expensive or more degenerate the care will get. Overall, I happen to think it's a good thing if I'm paying my doctor directly.

Social Darwinism - A Conservative's Best Friend

The late nineteenth and early twentieth century economic growth in America was filled with greedy industrial, oil and coal barons who felt that their 'survival of the fittest' mentality was justified, and even fit within the religious rule of the day. This attitude allowed the rich to become richer thanks to the sweat of low paid workers who received little or no healthcare, few benefits to provide sustenance for their families when no work was available, and without much for retirement support, most workers worked until close to death. This mentality brings despair to the lower classes, which eventually brings about some sort of revolution, not unlike the changes we saw in the 1930s due to severe economic depression and in the 1990s after 12 years of conservative, pro-business economic development.

The economic changes that the American Conservative Movement are asking for aren't evil in their own rights, it's just the idea that some are more deserving of wealth and prosperity than others that seems illogical. If in America all have equal opportunity to prosper, then why is there still poverty? Are some people lazier than others? Or, are some just unlucky? It may be so, but many people don't have the advantages of wealthy parents, an advantage that makes it easier to prosper. Social Darwinism alludes to a moral inequality of sorts - which makes it easy for the wealthy to look down on the poor, assuming that it is a lack in morality that causes the laziness that keeps people poor rather that the feelings of despair that are usually at the root of the problem.

As for the requested changes, I'm in agreement for the most part, only because I see the changes as potentially strengthening our economy in the world market, but I feel that in order to make taxation fair, it's best to remember that the increased tax burden on the richest ten percent in America (usually business owners) allows compensation for the poorest ten percent who toil endlessly to help make the former rich. And when we look at who it is that needs financial assistance from the government, it's easy to see why shifting the burden of taxation in equal portions to all Americans, rich and poor, could easily cause an economic inefficiency - why take taxes from the poor, which serves to reduce their consumption in the market, thus forcing them to ask for tax-based assistance for basic needs like healthcare, food and housing. We've seen how subsidies work to raise the standard of living for the poor by giving them greater choice in the marketplace, and we've seen what that improvement in choice for the poor does to non-recipients as well. The Social Darwinist conservatives in the top ten percent don't see that shifting the tax burden places an unrealistic burden to the middle classes as well by decreasing their activity in the market, which eventually affects the value of market goods by decreasing demand and raising prices of consumer goods.

So what is the answer to the effects of Social Darwinism in America? Well, first we have to agree to either accept Darwin's theories in their entirety, or we need to agree that all in America have the right to work towards prosperity, even if it means an added benefit to the poor in order to allow them to more easily achieve prosperity. I say tax the richest about 25% as a compensation to the poor who work hard to help the rich get richer, leave the poor alone as far as taxes go, we're most likely going to give it back to them in subsidies like the Earned Income Credit anyway, and remember that the middle 80% are working hard to make the economy of this country strong, so fair taxation, about 10% is warranted. But mostly I think we need to let the science of Darwin stand on its own in our public schools and leave the opinionated ideology of Social Darwinism by the wayside.

Denver's High-100

Though Rodriguez may say things such as "...if you're a stoner it's easy to get confused", she then quoted Mason Tvert as envisioning "a system of tax and regulation where private people are licensed to grow and sell." Personally, I found that to be a great vision - and I'm not even a pothead.

America has a long history of making certain vices legal for consumption, and therefore taxation and regulation. Alcohol is the prime example, but then there's cocaine (Coca-Cola, anyone?), hemp (legal during World War II, it is now illegal to grow in the U.S.), and at least in Nevada, prostitution. Even something as controversial as abortion is okayed. On the other hand, the government also has a long tradition of declaring very private acts among consenting adults as "illegal". If I get confused at all, its because of the schizophrenic laws brought down from on high.

I will admit that I have a bias in believing that marijuana is less harmful individually and socially than alcohol is, and I do understand the initiative to bestow cannabis with the same status of alcohol (even though this initiative covered only private, in-home use). With that in mind, I wonder if it wouldn't in fact be more wise to legalize and regulate that industry, and subject it to taxation. Although the number one crop in North Carolina is officially tobacco, the number one cash crop is illicit marijuana - why shouldn't they pay taxes too? Anti-marijuana proponents might even consider that one of the effects of a tax is to lower consumption of a good; so if growers and distributors were taxed, and passed the tax on to the consumer, the effect may actually be desirous. I'm figuring that the burden of the tax would then lie on the consumer, because believe it or not, a pothead's need is fairly inelastic. Also, I'm not considering here the "moral" concerns - quite frankly I don't think that American society is prepared to handle the additional child-rearing responsibility that comes with such freedoms.

From an economic standpoint, is this policy sound?

Tuesday, November 29, 2005

The Minimum Wage Debate

With more jobs comes greater efficiency. More employees means that things will generally get done faster, hence greater efficiency. With greater efficiency, the businesses will be maximizing their production and labor force. With minimum wage laws, this does not happen. Minimum wage creates less efficiency because employers can afford less workers. From an economic efficiency point, this makes no sense.

Many people complain about outsourcing jobs, but what do you expect to happen when companies know they can pay cheaper wages in another country? If minimum wage laws are dissolved, companies would have fewer incentives to outsource which would create even more jobs with those companies opening in the U.S.

It seems to me that no matter how you look at minimum wage laws from an economic stand point, you come to the same conclusion: minimum wage laws don't make sense. To maximize our workforce efficiency we need to eliminate the laws that prevent it from happening.

A Sound Motto

"So, while it sounds warm and fuzzy to provide cheap apartments for people who cannot afford them, it just doesn’t work that way."IT JUST DOESN'T WORK THAT WAY!

Castle Rock v. Gonzales

Case: Jessica Gonzales called the police multiple times because her husband had violated a restraining order against him and taken her children. The police did not do anything and the husband murdered the children. Gonzales based her case on the idea that when the restraining order was issued the State of Colorado assumed a certain amount of responsibility to enforce the restraining order through its police power. She held that the lack of action on the part of the police was a violation of the due process clause of the Fourteenth Amendment.

Decision: The Supreme Court decided that Castle Rock was not in violation of the Fourteenth Amendment, since Gonzales did not have a property interest in police enforcement of the restraining order against her husband.

Correct or Incorrect: I struggle with determining whether the court decided correctly. It seems to me that this is the perfect place for the Supreme Court to act in accordance with the protective state, but they did not do so. Obviously, the corrective state is not really at issue here. It seems to me, though, as much as it bothers me, that the court decided correctly.

I think this case proves a good point with regard to the Constitution and the protective state. Even though it is a reasonable to expect the government to protect us from harm, the government can only act within the framework provided for it (or at least should). Since this case was framed by the Fourteenth Amendment, the Supreme Court did what it could. I think this illustrates some of the dangers of an over-reliance on government intervention. I also think that it is a clear illustration of the limits of the Constitution. There was definitely a tragedy that could have been prevented by effective use of police power, but the Constitution appears to be silent on the subject. I certainly found the analysis interesting, and I think it illustrated an idea worth a few minutes of thought.

Video Game Industry

Friday, November 25, 2005

Is Donation Regulation Constitutional?

I realize that the government is trying to protect the whole of the population by not having the "rich" take control but everyone is saying that everyone else is richer than they are. When it is all said and done I don't think that this is an issue that needs to be controlled as I said if someone wants to do something that has restrictions they will find a way around it. I think that it is when the restrictions are put in place that corruption is more likely to occur. If donations where out in the open we would then be allowed to judge whether the donation was given out of support (tax right off) or if there was a deal made during the donation.

Thursday, November 24, 2005

Black Friday

This time of the year also allows for retail stores to clear their shelves and get ready for the new inventory for next year. Not only is this a great way to sale the items at a 30-50% discount but increases some of the revenues that they can take in before marking items down by 80%. Now there is a dilemma, do I wait to get that extra 30% off of that item that I want tomorrow, odds are no, I love to shop and get a deal, so if it is in my budget I am getting it!! I know growing up that my grandma would have a section of her closet devoted to presents of all kinds, most of these accumulated during these great sales. Sometimes I noticed that things went to waste or where just given away in the most random occasions. The retailers know that most people who are shopping tomorrow are going to be impulsive and that is a big key to the high revenues that are brought in on Black Friday. Of course most things will be used and given away but there is something about getting that deal and the satisfaction that makes us want to consume more.

Wednesday, November 16, 2005

Abortion and the Constitution

A recent article in the New York Times revealed the above quote, written in 1985 by the Supreme Court nominee Samuel A. Alito Jr. This is a fascinating statement considering our focus in the Constitution and Economy class. I do not really want to discuss the normative implications of the statement because we all have personal beliefs about the rightness or wrongness of abortion. What I would like to do is simply look at the words of the CONSTITUTION for evidence which either supports or condemns the claim made by Alito above.

"...the Constitution does not protect a right to an abortion."

Without getting into the details which so often hold up conversation, i.e. the ethical/biological/spiritual details, I think we may be able to formulate an argument that is consistent with the Constitution. We can say that if the Constitution grants the power to Congress to PROHIBIT abortion then, as Alito claims, there is no RIGHT to abortion. However, if the Constitution does NOT explicitly grant the power to the government to PROHIBIT abortion, then we know we have a RIGHT to abortion. The Constitution either protects the "right to an abortion" OR it grants the government the power to deny it as a right. As far as I can see, these are the only two options in this matter.

As we know the Constitution specifically outlines the role of government; it grants express powers to Congress to make laws which are necessary and proper to fulfill that role, which is explicitly written in Article 1, Section 8. It is apparent that nowhere in the Constitution does it say that Congress has the power to regulate or prohibit abortion. Congress can pass laws to regulate Interstate Commerce, levy taxes, and promote the General Welfare and Public Health. I don't see how abortion falls into any of these categories which would require government intervention. This leads me to see the Constitution as protecting the RIGHT to abortion, contrary to Alito's view. The 9th Amendment tells us that just because the Constitution does not state every single right that we have, we still retain them. I believe this is relevant to the issue at hand; do we not, as an individual, own our body, i.e. have the right to do with our body as we choose as long as it does not harm another person? I understand that the term "person" is ambiguous since some consider a fetus a "person" which means a woman can not Constitutionally cause him/her harm. However, if a fetus is NOT considered a "person" then a woman does have a right to do with her body as she chooses. This is beside the point; the 9th Amendment protects our rights that are not expressly stated in the Constitution, and the 10th Amendment makes clear that unless the Constitution gives government the power, the power is reserved to the States or the people. This is a check against legislating morality. Since we did not SPECIFICALLY give government the power to PROHIBIT abortion, then the 9th and 10th Amendments guarantee that the right lies with the people. I'm not even going to address the 14th Amendment (upon which Roe v. Wade was decided) because the right to Privacy is basically captured in the 9th and 10th.

No doubt there are moral quandries here that will lead people to disagree on whether they BELIEVE it is right or wrong, but from the perspective of the Constitution there is no justification to support the quote above. Therefore, I think that Alito, in saying "...the Constitution does not protect a right to an abortion" is wrong.

Tuesday, November 08, 2005

Vaccines & the Heavy Hand

"I've often suggested that when you hear about a 'shortage' of something, you should first suspect not that the invisible hand in involved, but rather that the HEAVY HAND of government in involved."Check out my comment as well as the post by Russell Roberts that is linked.

Thursday, November 03, 2005

Mother Of All Debates

"The Democrats will pull out all stops in an attempt to defeat this nomination. Ultimately, they will lose the battle. Conservatives who are now happy that President Bush did not squander his opportunity regarding this nomination, must now be careful not to squander their opportunity of having the “mother of all” debates.What do you think? Are we going to have a debate about whether the Supreme Court should see the Constitution as an effective and significant constraint to national government power? I suspect we will not. Unfortunately, the political issue for debate seems to have been framed as: Should judges legislate from the bench? I think this question is easy to answer in principle: No.

The essence of the debate we are about to have is:

* Do we want the Federal Government to be bound by, and pay attention to, the Constitution?

*

Or, do we want our Federal Government to be able to disregard the Constitution when the expedience of the moment provides them with cover?

Liberals, most Democrats and far too many career Republicans do not want the debate framed so that it focuses on the Constitution. They want the debate to be about the man and whether he should have a seat on the Supreme Court. At the end of the day, the most likely scenario will be that conservatives win the seat, but miss the opportunity to move the nation back towards the original intent of the Constitution."

I would hope we would discuss whether the Court should see the Constitution as evolving as Justices come and go, and as their views of evolving culture change, or whether the Court should see the Constitution as evolving through the formal ratification process. The first view seems to see the Constitution "living," and instead of seeing the Court's role as constraining government, it seems to see its role as finding a way for the Constitution to facilitate government's efforts. The second view seems to see the Constitution as limiting government's power and efforts, and it relies on WE THE PEOPLE to facilitate changes in government through the formal process by which the Constitution allows amendments.

I like the second view, and I think our country would benefit from a vigorous public discussion of these two views. Do you agree?

Wednesday, November 02, 2005

Commerce Power Constrained

"Judge Jones concluded her analysis by pointing out that:

Lopez reminds us forcefully that Congress's enumerated power over commerce must have some limits in order to maintain our federal system of government and preserve the states' traditional exercise of the police power. Section 922(o) is a purely criminal law, without any nexus to commercial activity, and its enforcement would intrude the federal police power into every village and remote enclave of this vast and diverse nation.

United States v. Kirk, 70 F.3d 791, 799, 802 (5th Cir. 1996) (Jones, J., dissenting)."

Tuesday, November 01, 2005

Social Security and Ownership

But, how can you NOT own that benefit, if you worked for it?

The following proposal is called, GROW (Growing Real Ownership for Workers) and S1302 Proposal. It is designed to prevent Congress from spending the surplus and allow individual workers to save money toward their retirement. The proposal reads as follows,

Although there are differences between the House and Senate versions of the proposal,

at the core both are built around the same concept and provisions:

• Workers under the age of 55 could

choose to remain entirely within the

current Social Security system or participate

in a personal account option.

• The accounts would be financed through

a rebate of surplus Social Security taxes

(directly in the case of S1302 and

through an equivalent general revenue

transfer in the House version). That surplus

would be defined as the difference

between all OASDI tax income for a given

calendar year, minus the cost of paying

Social Security benefits for that year, plus

administrative costs. Each worker would

receive a rebate of payroll taxes directly

proportional to the size of the surplus as

a percentage of the system’s total tax

receipts.4

• Initially, workers could invest in government

bonds only. Unlike the special issue

bonds issued to the Social Security Trust

Fund, these would be fully marketable

government securities. Beginning in

2008 under the Senate proposal and in

2009 under the House plan, workers

would be offered additional investment

options.

• Workers would own the funds in their

accounts and those funds would be fully

inheritable.

• At retirement, benefits from traditional

Social Security would be reduced by an

amount proportional to the account

contributions, plus an offset interest

rate equivalent to the realized yield on

U.S. Treasury bonds less an administrative

fee of 30 basis points.

• At retirement, workers could, but would

not be required to, convert the funds in

their account to an inflation-adjusted

annuity.

http://www.cato.org/pubs/pas/pa550.pdf

This may be a small step towards reform but it is seems like a plausible one.

Monday, October 31, 2005

Social Security

In article 1 section 8, the constitution details the areas of spending that government has the power to tax. From what I gather from reading it, it grants the power to tax to provide for militia, the army, for tribunals, to provide for the common defense and general welfare of the United States. It does not read, "provide for the financial well being of the citizens." That section is not redistributive in the sense that social security is.

From the corrective state view of the constitution, the social security program absolutely does not make the economy more efficient. It is taking money out of the hands of people who earned it, with no security, no gaurantee that the money will even be there fifty years for now. Efficiency analysis would dictate that the social security tax should be scrapped.

The protective state holds that the interpretation of the constitution should protect individual liberty. Individual liberty would say that people should be able to make their own decisions, and not be liable for the well being of people they aren't involved with. It could sound selfish, but it isn't. It's letting the economy take care of things, letting people make their own honest decisions in a process that will improve the economy and lives all the while.

Social Security Reform and You

If Social Security, Medicare, and Medicaid don’t get reformed by 2040, government spending will increase to 27.1% of the GDP, compared to about 19.9% in 2003. And this is assuming that the other discretionary parts of government spending will stay at the same relative percentage of the GDP, which could turn out to be an immense understatement. The large retiring baby boom generation, along with higher life expectancy, and raising health care costs are all attributing to the problems that are expected to arise in the current Social Security system. The Projected OASDI, (old age survivors disability insurance), shows that in 2017 the Social Security program will be running a deficit, but redeeming treasury securities will compensate for the deficit until 2041, when the treasuries will be depleted. Social Security reformation is undoubtedly needed, but what if any are the clear cut answers?

In 1936 the dependency ratio, the number of retirees to the labor force, was 15%, and in 1997 it was 29%. But by the year 2030 it’s expected to be 50%. This would imply that the current tax rate to pay Social Security pensions would have to rise to 17% in 2030, compared to 12% in 1996. Is a higher continuing OASDI rate necessary for sustaining the problems we will face? It seems that could be an answer if we want to maintain Social Security benefits. Another option that has been proposed is to create personal accounts. These accounts would be run and administered by the Social Security System, and individuals could choose how to invest their funds among stock and bond mutual funds. The pensions that individuals would receive from the individual account would originate from how much they contributed and how well their investments fared. This approach would require a 1.6% increase in payroll taxes, and would raise the retirement age to 67 by the year 2011, and allow the retirement age to be raised in the future based on longevity of the population.

The advantage of a privatization scheme is that it could increase the return to Social Security payments. However the flood of new money into the stock market along with the high cost of administering the small accounts would reduce their potential net return substantially. I think we should try and increase our national savings rate because the Social Security system gives us a false illusion that the taxes we pay are going to be there for us when we get older. Obviously this is not the case, because we will not receive our paid taxes, but instead the taxes on earnings of future workers. When our time comes to collect Social Security payments, if that be in the year 2045, the payroll tax would have to be 5% more than what it is today to compensate for the higher life expectancy, higher health care costs, and a higher dependency ratio. This is not sustainable and I plan on accumulating enough wealth so I will not have to be dependent upon Social Security.

If Social Security Looked Like Insurance…

Except for that fact that Congress has made it so that large corporations can dump their retirement obligations, thus wiping out workers’ retirement assets that they either worked their entire adult lives for, or sacrificed some of their ‘consumption today’ to invest in 401(k) plans that they anticipated having. Granted, 401(k) plans are meant to be supplemental to other retirement investments, and I bet that many savvy workers invested this way thinking that they were hedging their bets against their employer’s retirement compensation and what they anticipated getting from Social Security. And, oh yes – think that ESOP plan is safe? Think again.

The Broken Promise in the October 31, 2005 issue of Time gives a scary overview of how employees have been bilked out of their entire employee-sponsored retirement plans. These are employees that thought they were planning well for their Golden Years, so as to not be a burden to society and their loved ones. Thanks to Congress’ love of big business at the expense of the mass of citizen workers, these people are now left destitute. These would be the workers that would not have had to pull upon a Social Security insurance-type payment, but now would have been forced to draw upon this program. If there continues to be no strong laws and rules for corporations that offer retirement plans, 401(k)s, ESOPs, etc, then there will be no impetus to save through these avenues. What then would the options be? Not everyone has the wherewithal to invest in real estate, not everyone is comfortable with buying and selling on the open market.

In light of what employers are currently permitted to perpetrate against their own employees, I think that there had better be some serious financial education of our youth well before any changes to Social Security are made.

Could we learn something from india?

This India example is a classic example of how pareto improvements can be made to economies, as well as the economic health of a country. Lower taxes benefit growth. There is a quote in the magazine explaining the hard road ahead of India to sustain this growth. It states that the problems India is encountering "is a reminder of just how powerfully politics can constrain economics."

So, maybe we should lower taxes in America to increase growth and efficiency. Lower taxes would give more money to the people who are earning it in the U.S. More money in their hands would let them make their own decisions that would ideally put them on a higher indifference curve, and find a more efficient allocation of resources. This could be very useful considering that 50% of people in the U.S. don't pay income taxes, and the upper echelon of income earners find as many tax deductions and other advantages that they can. Economically speaking, if the government stopped taxing to pay for goods and services that aren't "public" in the economic sense, and gave people more money, there would be more incentive for growth, for development, for new products. This would enable people to achieve as much benefit as possible while stimulating the economy.

The Myth of "Strict Construction"

For the first 150 years, our Constitution stood as our Founders, and more importantly, "the people," intended, as is, in accordance with its original intent. Prior to the reign of Franklin D. Roosevelt, the courts were still largely populated with originalists, who properly rendered legal interpretation based on construction of the Constitution's "original intent." However, FDR grossly exceeded the Constitutional limits upon the authority of his office and that of the legislature in his folly to end The Great Depression. FDR's extra-constitutional exploits opened the door for the judiciary to follow the same path: To read into the Constitution what was necessary to make it conform to the demands of the prevailing political will.

In the decades that followed, the notion of a "Living Constitution," one subject to all manner of judicial interpretation, took hold in the federal courts. Judicial activists, those who legislate from the bench by issuing rulings based on their personal interpretation of the Constitution, or at the behest of likeminded special-interest constituencies, were nominated for the federal bench and confirmed in droves.

Consequently, we now have a Constitution in exile, it has become a little more than a straw man as the courts have become increasingly politicised. In recent decisions, judicial activists on the Supreme Court have cited "national consensus" and "international law" as factors in their decisions.

The Federalist Papers, as the definitive explication of our Constitution's original intent, clearly define original intent in regards to Constitutional interpretation. In Federalist No. 78, Alexander Hamilton writes, "the judicial branch may truly be said to have neither FORCE nor WILL, but merely judgment...liberty can have nothing to fear from the judiciary alone, but would have everything to fear from its union with either of the other departments." In Federalist No. 81 Hamilton notes, "there is not a syllable in the Constitution which directly empowers the national courts to construe the laws according to the spirit of the Constitution."

George Washington advised, "The basis of our political systems is the right of the people to make and to alter their Constitutions of Government. But the Constitution which at any time exists, 'till changed by an explicit and authentic act of the whole People is sacredly obligatory upon all."

Today, 218 years later, Justice Antonin Scalia says of judicial activism, "As long as judges tinker with the Constitution to 'do what the people want,' instead of what the document actually commands, politicians who pick and confirm new federal judges will naturally want only those who agree with them politically."

While the words "conservative" and "liberal" are ubiquitously used to describe Republicans and Democrats respectively, these words properly should describe whether one advocates for the conservation of our Constitution, as originally intended, or its liberal interpretation by judicial activists. Does one want to conserve Constitutional limits on the central government, or liberate those limits?Our Constitution was written and ratified "in order secure the Blessings of Liberty to us and our Posterity" as set forth in the Declaration of Independence "endowed by their Creator." It established a Republic intended to reflect the consent of the governed, a nation of laws, not men. At the close of the Constitutional Convention in Philadelphia, Benjamin Franklin was asked if the delegates formed "a republic or a monarchy." He responded, "A republic if you can keep it." We have all but lost it.

Inherence Tax

Imagine that you owned a small auto shop and you died. All your money and assets were tied up in the shop and your two boys who worked the shop with you inherit your business. Before your boys could do anything the Internal Revenue Service comes and values your business at 5 million. Now your boys have to pay taxes on that 5 million. Yet, they have no cash to pay the taxes so they have to sell the business to Pep Boys. In a best case scenario say that Pep Boys pay 5 million for the company. Now your children can pay off the inheritance tax and your income tax with some money left over. The money that is left over is substantially less then what you wanted to leave them and they are out of a job. Not only that but, all the employees that use to work at the shop are now unemployed and Pep Boys is the only store within miles to offer auto supplies and services. Pep Boys can now mark up their prices.

In response to society’s actions because of inherence taxes an act was passed. In 2001 George Bush signed the Economic Growth and Tax Relief Reconciliation Act of 2001. This law states that the federal estate tax exemption increased to $1 million in 2002 and will continue to gradually increase to $3.5 million in 2009. Then in 2010, the federal estate tax ends and in 2011 the federal estate tax is resurrected to the rates that occurred in 2001. Not only that but the top federal estate tax rate decreased in 2002 to 50% and will continue to decrease to 45% in 2009. In 2010 there will be no federal estate tax rate. Then the top federal estate tax rate will be revived to 55% in the year 2011. Lastly, in 2010, a "carryover basis" rule will apply, which will tax heirs on the capital gains they inherit. As it stands now, heirs who decide to sell an asset don’t have to pay any taxes period. However, in 2010, heirs who sell an asset will have to pay an income tax on the asset if the asset is sold for more than it was bought for.

The Economic Growth and Tax Relief Reconciliation Act of 2001 is the first step in eliminating the tax. Yet, one thing should be changed in the act: the old tax rates should not be revived in 2011.

It hurts the economy when small farmers and businesses are forced into sale or bankruptcy. The bigger corporations have less competition and more free rein to do what they want to do. What the government should do is phase out the inherence tax all together forever. By doing this people can inherent small businesses without having to sell their business just to pay the taxes on it. If the business is allowed to continue, it will still be producing payroll taxes and income taxes. The people who are employed at the company will be paying their taxes and will not be unemployed. In the end these taxes the business generates will be more taxes collected then the inherence tax would have collected. This fact has been proved over and over by our own system of government. When we lower taxes either on a state or national level we increase the economic expansion of our nation, spurring a larger tax base to collect on, and increasing the revenues the government has available to operate. When we increase taxes, we slow economic activity, lower the base of revenues we can collect, and fall into a downward spiral which usually causes economic depressions.

Miers Nomination

Hamdi Habeas Corpus

The writ of Habeas Corpus has been protecting individual freedom since its English creation in the late 1600’s

The Bush administration has said that Hamdi didn’t need legal advice because he has not been charged with a crime. If he hasn’t been charged with a crime then why has he spent the last two years in a brig? Without a crime being charged, the Bush administration has effectively not "produced the body", and had no legal ground for keeping Hamdi locked up. This was a violation of the Writ of Habeas Corpus and the Bush administration has defended this holding because he was an “enemy combatant.” Nowhere in the Constitution does it say Habeas Corpus can be suspended upon the proof that the detainee is an enemy combatant. The only time Habeas Corpus can be suspended is in times of rebellion or invasion, and Hamdi case certainly does not fit into either of those two categories. The only time when Habeas Corpus was suspended was when

Fortunately in Hamdi v. Rumsfeld, the Supreme Court ruled that detainees must have the ability to challenge their detention before an impartial judge. I completely agree with this decision because the Executive Branch does not have the power to indefinitely hold a

TABOR Revisited

Even before it was enacted, Colorado Democrats sensed and feared TABOR's potency. In fact, during the 1992 campaign Governor Roy Romer repeatedly denounced TABOR, saying that defeating TABOR was the "moral equivalent of defeating the Nazis at the Battle of the Bulge." He personally attacked TABOR's author Douglas Bruce, calling him "a terrorist who would lob a hand grenade into a schoolyard full of children." Finally, Romer predicted that TABOR would result in an economic Armageddon and warned that the Colorado border would have to be posted with signs reading, "Colorado is closed for business."

However, since 1992, nothing of the sort has happened. In fact, Colorado's economy has been exceptionally strong. Between 1995 and 2000, Colorado ranks first among all states in gross state product growth and second in personal income growth. Furthermore, according to the National Association of State Budget Officers, Colorado was one of only five states that did not run a deficit during fiscal 2002. In addition to providing tax relief and fostering economic growth, TABOR has also forced Colorado residents to see the costs inherent in government programs. In other states, residents often support higher government spending because they can see the benefits of a particular program, but remain blissfully unaware of the costs that they and other taxpayers will be forced to bear.

However, in Colorado the annual tax rebates brings these tradeoffs clearly into focus. In every year from 1993 to 1999 there was a proposal on the ballot to either raise taxes or increase spending in excess of the TABOR limit. Knowing these initiatives would markedly reduce the size of their annual tax rebate, voters soundly defeated each of these measures. In 2001, for the record, an initiative to increase spending for Colorado schools did pass. However, Colorado taxpayers still received tax rebates totalling more than $900 million from fiscal 2001 revenues.

Because of this long-term success, Colorado's TABOR may well surpass California's Proposition 13 in terms of effectiveness. In 1978, Proposition 13 did an excellent job of providing taxpayers and homeowners with some much needed short-term tax relief. However, since it failed to restrain expenditures, the California state legislature eventually increased other taxes to compensate for the loss in property-tax revenue. For instance, in the years following the passage of Proposition 13, California raised the income tax, the sales tax, and taxes on beer, wine, and cigarettes. During the early 1990s, former Governor Pete Wilson even proposed increasing taxes on snack foods. This vicious cycle of spending and taxing is the root cause of California's current fiscal mess.

Overall, Colorado's Taxpayer Bill of Rights has quietly become America's most effective limitation on government. It has kept spending in check, provided tax relief to Colorado residents, and deserves a great deal of credit for Colorado's strong fiscal position.

Supreme Court

Sunday, October 30, 2005

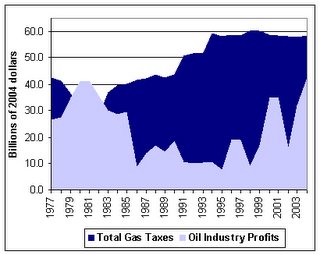

Gasoline: Taxes v. Profits

From TaxProf Blog:

"Since 1977, governments collected more than $1.34 trillion, after adjusting for inflation, in gasoline tax revenues—more than twice the amount of domestic profits earned by major U.S. oil companies during the same period:"Now, that's interesting.

Privatizing K-12 Education

I propose privatizing K-12 education to not only free up Colorado's financial obligation to K-12, but doing so would also increase efficiency. The article that is attached to this posting is a study that was done in Hawaii, after that state faced similar budget problems. The study compared private and public K-12 institutions, as well as private and public higher education institutions (however, for the purposes of this posting, I will focus solely on the finding of K-12).

The study found that private schools do a better job at hiring more teachers, which results in smaller class sizes (lower per pupil to teacher ratio), than public institutions. This results in more focused attention on individual students. Private institutions have higher test scores and higher teacher morale. The study shows that income growth in Hawaii is about five times as much with private institutions as it is with public institutions. This just means that the study shows a correlation between increases in participation in private K-12 and increases in gross product per capita. The study does show indicate some benefit from public K-12 in the long run, mainly because more students attend public K-12 rather than private and because some students who would go to private schools in Hawaii, end up going out of state to other private K-12 schools, because their parents can afford it. The survey indicates that the state legislatures should keep this data in mind when deciding what course to take, because private K-12 education helps promote efficiency and competition.

If we transfer some of these ideas to the current status of Colorado's educational system we could alleviate, or at least minimize, many of the budget problems. In 2002-2003, Colorado spent $7,384 per K-12 pupil, while the national average for cost of attending a private K-12 school is around $5,000. Colorado is spending over $2,000 per pupil more than it costs to attend a private school that generally has smaller class sizes, do better on tests, and recruit more teachers that are happier to be there (as seen in the study from Hawaii). If Colorado privatized their K-12 schools, this would create a massive market of K-12 competition, which would drive the cost of education lower-or at the very least stabilize it. It would also force the schools to manage their finances more than they currently do under the state system, because they would no longer have guaranteed state funding.

Of course there are potential flaws privatizing K-12, most importantly is the idea that some families wouldn't be able to afford to educate their children if they are forced to pay for it. This is definitely a concern that should be considered, but discounting the option of privatized based on this unproven idea is irresponsible. Privatized should be considered as a viable option to help resolve the state budget problems, create efficiency within K-12, improve the education that the students receive, and possibly increase state revenue, as shown in the Hawaii study.

Thursday, October 27, 2005

Miers Withdrawl

From reading her letter, it seems that Miers was concerned about the integrity of the executive branch. I find this admirable, and I appreciate her idea that it is the role of the Supreme Court not to make law, but rather to interpret the law.

Bush's reaction was interesting. He seemed to blame her withdrawal on what he seemed to consider unreasonable requests for documents that would help to inform people of her background. Though I understand that it is important to retain the integrity of the executive branch and the trust among the President and his advisors, I wonder at why it would be such a problem for Miers to speak with regard to her previous actions and as to what she would do with regard to interpretation of the law.

This situation serves as a good example to show why it would be helpful to require Supreme Court nominees to answer questions with regard to interpretation of the constitution. We never did learn what Miers' definition of commerce was as it applied to the commerce clause in the constitution. We also never heard what Miers' opinion was on whether or not the power to tax was limited. If she had been made a member of the Supreme Court, we would have had very little evidence to tell us how she would have interpreted a very important aspect of our government. I think, after reading her letter of withdrawal, we have a much clearer idea of what she would do if she was on the supreme court, but that is only in the face of her withdrawal.

It seems to me that if we nominate people to the Supreme Court without knowing how they would interpret it, we are being irresponsible in using a tool that we have for limiting government's coercive power and preserving our rights. Perhaps we would do well to encourage our President to be cautious in whom he nominates to the Supreme Court. I think that it is important to know how Supreme Court nominees would interpret the Constitution based on this particular event. Miers’ withdrawal should be applauded, in light of her not having any examples of her interpretation of the Constitution. She made an admirable decision, based on the power of the Supreme Court within our government, and based on the ability of the American people to trust her judgment.

Katrina & K-12 Vouchers

"Hey, this sounds like a voucher, we can't be doing things that way. It might work and things could then get out of hand. Vouchers in Colorado for higher education. Now vouchers proposed for helping children after Katrina. People may be starting to see there is wisdom in education vouchers, eh?"Read the rest.

Wednesday, October 26, 2005

The Problem With ATM's

However, the prime locations where a bank can install an ATM are limited. By establishing a greater presence of ATMs in these prime locations, the bank can secure a slight competitive advantage over its competitors by improving the benefits (lowering transaction costs) to its customers. The strength of a bank’s competitive advantage is reflected by the premium the bank can extract from non-bank customers who use the bank’s ATM machines. Therefore, when two banks consolidate, they are likely to achieve greater economies of scale and a competitive advantage by attracting more customers through a larger network of ATMs. If two banks agreed to allow reciprocal use of their machines (that is, bank A and bank B allow each other’s customers to use their machines at no charge) the outcome would not be the same as is achieved through a merger. If the two banks were separate, each bank’s investment in a new ATM location would provide a benefit not just to the bank making the investment, but also to the bank which has reciprocal rights to the machine. As a result, two separate banks would invest in fewer ATM locations than would the consolidated bank—therefore, the consolidated bank would attract more customers.

Tuesday, October 25, 2005

Minimum Wage: Women & Eugenics

Alex Taborrok notes a paper by Tim Leonard that probably provides the context:

"It's no surprise that progressives at the turn of the twentieth century supported minimum wages and restrictions on working hours and conditions. Isn't this what it means to be a progressive? Indeed, but what is more surprising is why the progressives advocated these laws. A first clue is that many advocated labor legislation 'for women and for women only.'Isn't it interesting that the constitutional jurisprudence that was created to support the constitutionality of the minimum wage we have today was erected on the foundation of an effort intended to keep women in the home and out of the labor force?

Progressives, including Richard Ely, Louis Brandeis, Felix Frankfurter, the Webbs in England etc., were interested not in protecting women but in protecting men and the race. Their goal was to get women back into the home, where they belonged, instead of abandoning their eugenic duties and competing with men for work.

Unlike today's progressives, the originals understood that minimum wages for women would put women out of work - that was the point and the more unemployment of women the better! "

Would anyone like to return to the constitutional foundations and decide that the first Court opinion was indeed correct and it is unconstitutional to impose minimum wages?

C & D Referendum Debate

I think that Colorado has experienced growth at an unprecedented rate the last fifteen years and the increased tax revenues weren't enough to keep the infrastructure expanding equal to the growth rate. In our Public Finance class, we're learning just how important it is to provide society with the basics, and although we haven't gotten into the taxation side of government sector economics, we are at least privvy to the needs of the individual, and it seems that many of those who are in need in Colorado, probably aren't receiving the benefits necessary to tide them over in rough times, and the current system obviously isn't bringing in enough revenue to allow the legislature of Colorado to do what they need to do to keep Coloradans satisfied. Mr Bruce states that these Refs. are just a ruse to get more money so they can expand the general budget since C & D don't specify EXACTLY where the extra revenue will go, and Mr. Hazelhurst, in his lack of any real political experience, says that it doesn't matter where it goes, it will help Coloradans in the long run either way. Mr. Bruce says keeping our refunds is unconstitutional since TABOR forbids the legislature from spending the revenue from excess taxation, and C & D will cost the average family of four over four thousand dollars over the next year. He brought some shaky math to the debate, mainly because the majority of Coloradans aren't part of a 'family of four' (I've been here six years, have a twelve year-old son and personally don't know any four person families!), and the math looked at statistics that bent and molded to whatever he wanted to show. I didn't like the fact that his chart showing how the general budget of Colorado had grown in dollar amounts, but weren't adjusted for growth (per capita spending) or true inflation rates. But I think it is the idea that his TABOR is the main point of attack by C & D that causes Mr. Bruce the greatest source of frustration, but, as a Political Science major here at UCCS, I think Mr. Bruce needs to remember one very important American Constitutional fact - any part of ANY constitution is open for both amendment AND repeal - this includes his amendment.

Here is a link to NBCs 5/30 report on the debate. http://www.koaa.com/news/view.asp?ID=4132

Saturday, October 22, 2005

Fire Department Wants to Charge for House Calls

An issue that has recently come up for Black Forest is the chance for the local Fire Department to charge for house calls. Currently non-emergency calls make up 5% of the responses that the Fire Department has to make. The Fire Department has been treating these calls for free, most of them consist of diabetes and asthma attacks. It is said that the average cost to respond to these calls is $150 for supplies. The department is suggesting putting a $100 fee to those that need their services. I don’t think that this is a bad idea although I wonder aren’t tax dollars used to purchase those supplies or is it only partial payment? If the Fire Department is experiencing this loss in supplies due to these calls I think that it is the best solution for the problem. Although 5% is not a large percent of the population these calls take away from the resources that could be used on people who are victims in household fires.

The charge of $100 for medical help in your home when otherwise you would have to seek medical help along with the $91 glucagons cost for those with diabetes seems to be well worth it not to mention the added cost to see a doctor! The opportunity cost of having medical service brought to you at a slightly higher cost than the medication seems like not too many people would want to give up that opportunity cost. It seems that the number of people treated by the Fire Department is fairly low and I would take into account the people that have health insurance and other resources to go to first. Black Forest has a wide variation of incomes and it seems with those variances would come different choices for health insurance. If one can avoid paying higher health insurance fees to get free medical treatment from the Fire Department this adds to the costs of the whole when they can be decreased with this new idea.

Talks about Eminent Domain

“Eminent domain is completely out of control.”. As Olson’s theory says one key to having a successful economy is to have well defined property rights. If the government is able to take our land for the public purpose we have no solid ownership of our land and this will decrease the demand for ownership. Who wants to buy land just to have it taken away to build a strip mall? Not me. The Supreme Court needs to reread the Constitution and say that public use is NOT public purpose; otherwise we are going against Olson’s theory and headed for a world of hurt.

We can is in Iraq the new economic opportunities they have and the hindrance that they had when the land was taken from them by the government in the past. This has been seen and proven that defining our property rights is key to growth in the economy.